5 BIR and SEC Regulations Every Company in the Philippines Should Know in 2025

Since the start of 2025, there’s been quite a few regulatory updates involving the Bureau of Internal Revenue (BIR) and Securities and Exchange Commission (SEC).

If you run a company in the Philippines or you’re a foreigner planning to do business in the country, you’re going to want to take a look at this post.

Here’s what you need to know.

Content Summary:

🎯 The BIR is implementing CREATE MORE’s reduced corporate tax rates for registered business enterprises.

🎯 A new value-added tax on digital services within the Philippines will be implemented starting June 2025.

🎯 The BIR updated the gross sales threshold for audit/investigation in select regions in the Philippines.

🎯 The SEC’s new paperless business registration is now mandated for domestic stock corporations — eliminating the need for hard copies of documents.

1. BIR implements reduced corporate income tax

The CREATE MORE Act, signed in late 2024, brought significant tax relief to encourage business growth. The BIR released Revenue Regulations 007-2025, detailing the specific rules in implementing the new law.

Here are the key takeaways:

- Lower corporate income tax: Registered Business Enterprises (RBEs) under the Enhanced Deductions Regime (EDR) now enjoy a 20% rate—down from 25%.

- Small domestic corporations: Companies with net taxable income not exceeding ₱5 million and assets not exceeding ₱100 million benefit from the reduced rate.

- Export-focused and domestic market foreign companies: Resident foreign corporations classified as RBEs under the EDR as provided in Section 294(C) of the Tax Code, can also take advantage of the lower tax rate.

- Input VAT now deductible: Under Section 34(C)(8) of the Tax Code, input VAT from local purchases, even if tied to VAT-exempt sales, is now deductible from gross income — another business-friendly move.

For more information on what CREATE MORE brings to the table, check out our previous post.

2. New value-added tax (VAT) for digital services

The new law on VAT on Digital Services will enable the BIR to collect 12% VAT on all digital service transactions in the Philippines.

The new law’s definition of “digital services” is broad, encompassing the following:

- Subscription-based platforms such as HBO Max, Netflix, Spotify, Apple Music

- Online marketplaces and platforms like Lazada and Shopee

- Cloud services including Google Drive and Amazon Web Services

- Digital advertising through channels like Facebook Ads and Google Ads

- Other services delivered automatically via the internet

Foreign tech companies that provide streaming services, online market places, and cloud-based services have until June 1, 2025 to complete BIR registration.

Non-resident digital service providers are not exempted. Here are the frequently asked questions on the new VAT.

3. BIR expands its e-invoicing system

The BIR resumes its rollout of the Electronic Invoicing/Receipting System (EIS) and now requires the following taxpayer groups to comply:

- Entrepreneurs and businesses engaged in e-commerce or internet-based transactions

- Taxpayers designated under the Large Taxpayers Service (LTS)

- Taxpayers identified as large taxpayers under RA No. 11976 (Ease of Paying Taxes Act) and RR No. 8-2024.

The deadline for mandatory compliance is March 14, 2026.

4. BIR updates its gross sales thresholds for audit

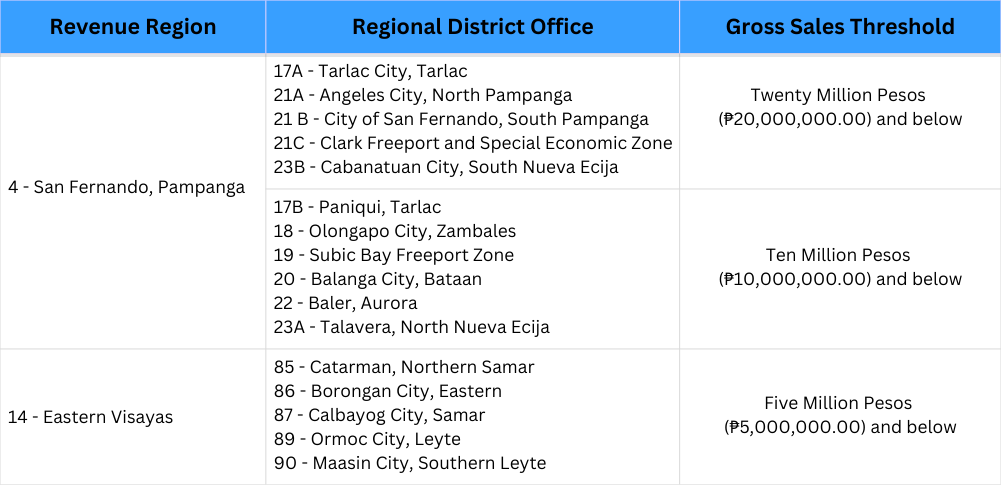

In Revenue Memorandum Order No. 07-2025, BIR updated the gross sales threshold that warrants an audit/investigation in select regions in the Philippines.

Businesses in the Philippines will now be flagged for investigation if they breach the updated thresholds below:

5. SEC now mandating paperless company registration

On April 7, 2025, the SEC began requiring all domestic corporations (including companies with foreign equity) in the Philippines to register through its Zuper Easy Registration Online (ZERO) application.

You can check Memorandum Circular (MC) 3, Series of 2025 for the official announcement.

SEC Zero eliminates the need for submission of hard copies of notarized documents, signatures, and other registration paperwork.

This new process is accessible through the existing eSPARC Portal and integrates with the SEC’s authentication tools: eSECURE and eSAP.

Meanwhile, lenders, financing companies, and foreign corporations are still not required to go through SEC ZERO — but not for long.

Three months after the implementation of MC, all types of corporations will need to use SEC ZERO.

Consult Loft for BIR and SEC business registration

Regulatory changes can affect how you register your business in the Philippines. And in 2025, there’s likely a few changes that you need to prepare for.

When you work with Loft, you’re not just ticking boxes for compliance, you’re staying ahead of the curve to make sure your business is running smoothly.

Complete the form below to make business registration and compliance a breeze.