5 Frequently Asked Questions About Business Registration in the Philippines

Let’s be real for a moment. Registering a business in the Philippines can get tedious and confusing real fast.

For several years now, we’ve assisted thousands of local business owners and foreign companies in sorting out their business registration requirements.

And, we’ve noticed quite a few recurring questions from our clients.

Here they are, answered.

Content Summary

🎯There are five major steps to register a business in the Philippines. It involves the SEC, BIR, and other government agencies as needed.

🎯Business registration in the Philippines is a weeks-long process, but some steps can run concurrently—saving a bit of time in the process.

🎯 Foreigners can own and operate businesses in the Philippines, subject to certain restrictions depending on the industry.

🎯A virtual office is a flexible business solution that gives you all the perks of a traditional office space—without its downsides.

1. How do you register a business in the Philippines?

In general, there are five steps to follow when it comes to business registration in the Philippines. There could be more, depending on the nature of your business.

Step 1: Register with the Securities and Exchange Commission (SEC)

The SEC is the government agency that regulates corporations and partnerships in the Philippines. All business registrations start here, as this step establishes the legal existence of your company in the Philippines. Take note that this needs to be completed before you can proceed with all the other steps below. The only exception is sole proprietorships, which need to go through the Department of Trade and Industry.

Step 2: Register with the Bureau of Internal Revenue (BIR) and the Local Government Unit (LGU)

Following SEC registration, you must register with the BIR to get your corporate Tax Identification Number (TIN). This allows you to fulfill your tax obligations. At the same time, you’ll also need to register with the LGU of the city where your business is located. LGU requirements vary, so it’s crucial to contact the specific local government office for specific details.

Step 3: File SEC post-incorporation reports

Once you get your corporate TIN from the BIR, you’ll need to file your initial General Information Sheet (GIS) with the SEC. Nowadays, this can be done online on the SEC’s eFAST portal. The GIS is an annual requirement, so you’ll need to remember to file it every year.

Step 4: Register with SSS, PhilHealth, PAG-IBIG (statutory registrations)

Next, if you have at least one declared employee, you’ll need to enroll with three government agencies for the following statutory benefits:

- Social Security System (SSS), which handles private employees’ pension fund;

- Philippine Health Insurance Corporation (PhilHealth) for the national health insurance; and

- Home Development Mutual Fund (HDMF or PAG-IBIG) for housing loans.

Step 5: Department of Labor and Employment (DOLE) Rule 1020 registration

Many businesses forget about this step since it comes later in the process, but it’s just as important as everything else! Once you’ve got your company up and running (including enrolling your employees with SSS, PhilHealth, and Pag-IBIG), you’ll need to register your company under DOLE Rule 1020. This ensures compliance with occupational health and safety standards in the workplace.

💡Fast, hassle-free business registration in the Philippines

Before putting in the work, we highly recommend consulting with the Loft team to make sure your business complies with all relevant government regulations.

We have a wealth of experience when it comes to helping companies sort out their business registration requirements.

To book a free consultation, email us at [email protected] or give us a call at +63-917-899-1111.

Additional permits (if applicable)

Depending on the nature of your business, you may require additional permits and licenses. For example, businesses involved in retail or wholesale will need to secure an import/export license from the Bureau of Customs.

2. Can foreigners own businesses in the Philippines?

Yes, definitely! With its strong labor force, excellent command of English, recent economic reforms and widespread adoption of digital technologies, the Philippines is a great place for foreign investors to grow their business.

Just keep in mind that the Philippine Constitution and other government regulations restrict foreign investments in certain industries. See the table below summarizing the 12th Regular Foreign Investment Negative List (FINL), based on Executive Order No. 175 issued by the Office of the President on June 27, 2022.

| Up to 25–30% foreign ownership allowed | Up to 40% foreign ownership allowed | Foreign ownership prohibited |

| ● Private recruitment ● Contracts for the construction of defense-related structures ● Advertising (30%) | ● Deep-sea commercial fishing ● Procurement of infrastructure projects ● Exploration and development of natural resources ● Ownership of private land and condominium units ● Operation of public utilities like power generation ● Educational institutions ● Processing of rice and corn products ● Private radio communications network ● Steam bath houses, saunas, massage clinics | ● Mass media ● Practice of professions (law, medicine, engineering) ● Organization of cooperatives ● Small-scale mining and utilization of marine resources ● Firecrackers and pyrotechnic devices ● Firearms, ammunitions, explosives (manufacturing, stockpiling, and repair) ● Retail trade (paid-up capital of less than $US 2.5 million) ● Ownership, operation, and management of cockpits |

3. What is the minimum capital requirement in the Philippines?

This is a tricky question to answer since there are many factors that play into it, like the industry you’re entering and whether your company is majority Filipino- or foreign-owned.

Generally speaking, we recommend a starting capital of ₱200,000– ₱1 million, which is the sweet spot to avoid unwanted regulatory scrutiny. Depending on your line of business, this estimate can comfortably cover all your overhead expenses, including registration fees, office rental and equipment costs, inventory, and employee salaries.

4. How long does it take to register a business in the Philippines?

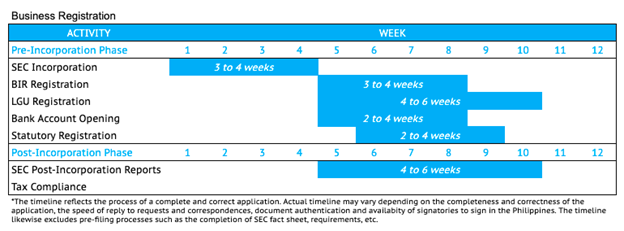

It depends. There are several moving parts to consider. Fortunately, there are some processes that can run concurrently, which can shorten your timeline. That said, the end-to-end business registration process can take anywhere from two and a half months to 10 weeks.

Here’s a timetable below for your quick reference:

5. What is a virtual office and is it better than renting office space?

A virtual office is, as the name suggests, allows you to use a remote location as a business address—without entering into a lease contract for office space.

A virtual office address can be used to register a business, open a bank account, meet with team members, and handle mail/packages. Plus, virtual offices typically have dedicated workspaces and meeting rooms.

In many respects, it’s almost exactly like having a physical office space—but with the following differences:

- Address without physical presence. Businesses can establish their presence in a city or locale without actually being there.

- Cost-efficiency. Virtual offices cost a fraction of what businesses usually pay for on office space rentals.

- Convenience. Virtual offices have dedicated staff that run and maintain the space for its clients. In other words, you don’t have to occupy the space yourself.

A virtual office is a flexible solution for small businesses, especially those that are just starting out and may not have the budget for their own space yet.

Looking for the best virtual office rates?

Consider getting a Loft virtual office in key business districts in the Philippines—Makati, BGC, Ortigas, Quezon City, and Cebu City.

Got more questions about business registration in the Philippines?

Is there anything else you want to learn more about doing business in the Philippines? Our team can help.

Loft has assisted a variety of local and foreign businesses with their business registration needs.

Complete the form below to register your business fast.